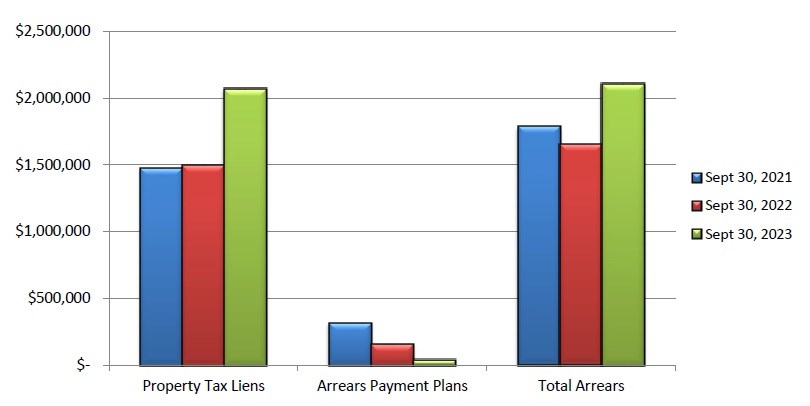

For the third-straight financial quarter, total tax arrears owed during 2023’s third quarter increased compared to 2022, while the amount of money from repayment plans continued to decline.

City administration presented the third-quarter financial report during the Nov. 27 regular city council meeting. Data about tax arrears and outstanding debt were contained within the document.

Council voted unanimously to receive and file the report.

Property tax arrears

As of Sept. 30, taxpayers owed $2,105,876 in total arrears, which included $2,068,455 in property tax liens and $37,421 in payment plans, the report said.

Conversely, as of Sept. 30, 2022, taxpayers owed $1,649,970 in total arrears, which included $1,495,321 in property tax liens and $154,649 in payment plans.

Therefore, the total outstanding amount of tax arrears increased by $455,906 from Q3 2022 to Q3 2023. This comprised a year-over-year increase in liens of $573,134 and a year-over-year decrease in payment plans of $117,228.

Meanwhile, by Sept. 30, 2021, taxpayers owed $1,786,478 in total arrears. This included $1,474,617 in property tax liens and $311,861 in arrears payment plans.

Finance director Brian Acker told council that this quarter’s higher arrears reflect the current economy and the financial challenges residents are facing. However, the fact that the amount of taxes collected versus what’s outstanding is on par with last year’s figures is great, considering city hall was delayed in sending out tax notices this year.

Coun. Crystal Froese expressed disappointment about the year-over-year increase in arrears, along with the fact there was a significant year-over-year decrease in repayment plan finances even though the municipality has programs to support residents.

“With that (lower repayment plan) number, you can really see the struggles that people are faced with in our community,” she said. “And I think numbers don’t lie. So that’s really concerning to me.”

In response, Acker said one reason for the lower number is city hall focused more on implementing its new tax system this year than working on payment plans. Secondly, people need the financial resources to participate in the repayment plans, something city hall is not currently seeing.

Property taxes receivable

Property taxes receivable consists of tax arrears and taxes owing. Tax arrears are overdue taxes, while current taxes are due but have not fallen into arrears. Taxes fall into arrears in the next year following the levy of taxes.

The total outstanding property taxes receivable as of Sept. 30 was $10,191,651, which included $8,085,775 in current taxes and $2,105,876 in arrears.

In comparison, total property taxes receivable that were outstanding by the end of Q3 2022 was $9,714,292, followed by $9,585,332 in 2021, $9,267,856 in 2020, $8,249,804 in 2019 and $8,192,714 in 2018.

Borrowing/debt

As of Sept. 30, there were five projects that city hall was still repaying after borrowing money to finance them.

The principal outstanding amount on each project was:

- Multiplex/Events Centre long-term loan: $11,676,000

- Waterworks capital long-term loan: $21,880,000

- High-service pumphouse: $7,339,000

- Buffalo Pound Water Treatment Corporation loan term loan (Bank of Montreal): $9,825,920

- Buffalo Pound Water Treatment Corporation loan term loan (TD Bank): $14,586,050.18

These five projects total $64,306,970.18, a decrease from $66,097,336.41 at the end of Q2; the debt limit is $95 million.

Meanwhile, the municipality is committed to a Buffalo Pound Water Treatment Corporation loan term loan of $14,300,000 in 2024. That amount will appear on the books next year, driving up the debt to roughly $80,397,336.41.

The next regular council meeting is Monday, Dec. 4.

In response to some providers blocking access to Canadian news on their platforms, our website, MooseJawToday.com will continue to be your source for hyper-local Moose Jaw news. Bookmark MooseJawToday.com and sign up for our free online newsletter to read the latest local developments.