A June 26 presentation to council on the city’s finances for the year ended Dec. 31, 2022 showed a downtrend from 2021, with various factors including an aging public works fleet and capital project obligations contributing to an operating deficit of $1.5 million.

Brian Acker, director of financial services for the City of Moose Jaw, gave a year-end presentation to council explaining the highlights of the 2022 financial statements. Those statements are now publicly available at moosejaw.ca/financial-budget-reports.

“Overall, our revenues decreased by about $5 million to $109 million, and our expenditures increased to $97 million,” Acker told Mayor Clive Tolley and members of city council. “The city’s operating deficit in the general revenue fund was significant at $1,486,440. That will be allowed to flow into our accumulated surplus, or if you prefer to call it our fiscal stabilization reserve, and we’ll be left with about $178,000.

“One comment I would have on that is the City of Moose Jaw is not alone in terms of having a deficit this year — probably as most people are aware, the City of Regina had a deficit for the first time in their history this year of $1.6 million. And the City of Saskatoon had an operating deficit in 2022 of just shy of $11 million.”

Key financial highlights from 2022

The following highlights are directly from the City of Moose Jaw’s financial discussion and analysis portion of its consolidated and audited financial report for the year ended Dec. 31, 2022:

- Net Financial Assets of $65.70 million, a decrease of $10.18 million as compared to 2021. The decrease in net financial position is related primarily to a decrease in financial assets of $4.41 million and an increase in landfill closure provisions of $2.93 million and an increase in debt of $2.73 million and some other small changes.

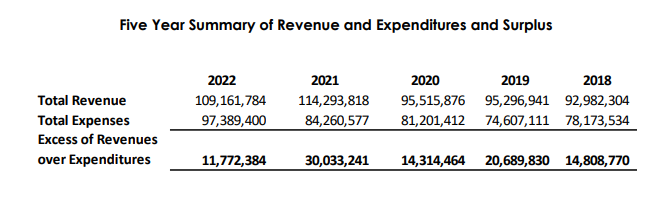

- The 2022 Consolidated Financial Statements show an annual surplus of $11.77 million as compared to the 2021 surplus of $30.03 million.

- The City’s accumulated surplus increased by $11.77 million as compared to 2021. The majority of the accumulated surplus is related to non-financial assets with the bulk of those being tangible capital assets. These tangible capital assets represent the service capacity available for future periods.

- Overall, revenues decreased by $5.13 million to $109.16 million, and expenditures increased to $97.39 million. The changes in revenues were driven by increases and decreases in a number of areas. Increases in expenditures were seen in all functional expenditure areas.

- The City’s operating deficit in the General Revenue Fund (Operating) fund was $1,486,440. This brings the City’s remaining accumulated surplus from operations to $178,488.

- The City’s debt increased $2.73 million in 2022 bringing it to $68.74 million. As well, the City committed to borrowing an additional $14.3 million for the Buffalo Pound Water Treatment Plant renewal in 2024. The City’s current debt limit is $95.0 million.

- The City’s reserves decreased by $8.64 million to $107.3 million. The bulk of these reserves are managed by a professional investment manager with revenues from investments funding various City Programs and Services. This investment revenue provides a sustainable source of income to the City and without this revenue, taxes would need to increase.

Acker’s explanation of report

“One of the things I should mention, which is sometimes confusing, is when we see a surplus of $11.77 million, we think, ‘Oh, that’s fantastic, we’ve got $12 million more,” Acker said to council. “But the reality is it’s the Public Sector Accounting Standards (PSAS) and how we must account for those monies.”

Acker explained that when the City purchases tangible capital assets such as roadwork equipment, the asset’s cost is amortized over time — but the funding is recognized in the year it is received. This can give an illusion that increased revenues are coming in, when what is actually happening is that capital assets are being purchased and the money is not available for other uses.

“We’ve directed those revenues to those tangible capital assets and over time, that’ll get consumed as we utilize them,” Acker continued. “So, overall, our revenues decreased.”

When the additional Buffalo Pound Water Treatment Plant project commitment comes through in 2024, the city’s debt will increase to just over $80 million.

The majority of the decrease of $8.64 million in city reserves was due to unrealized investment returns.

Taxation in 2022 totaled $33,453,351, an increase of $2,678,437 over 2021. Taxation represented 30.64 per cent of total revenues.

A comparison of Moose Jaw, Prince Albert, Swift Current, Regina, and Saskatoon shows that Moose Jaw’s taxation per capita is the lowest of the five thanks to its unusually strong investment earnings.

The second greatest source of revenue came from utility earnings at $29,634,526 or 27.15 per cent. Utility revenues come from waterworks and wastewater and from the city’s share of the Buffalo Pound Water Treatment Corporation.

Thirdly, 19.88 per cent of overall revenue came from contributions, grants, and subsidies, totaling $21,698,381. Provincial revenue sharing, gas tax funding, and grants make up the majority of this source of funding.

Expenditures in 2022 increased across the board, with Public Works expenses making up the majority of the $2.2 million over budget.

“In 2022, for the first time in recent memory, we actually over-expended our snow removal and sanding … causing us to dip into our reserve,” Acker said. That area usually has a surplus, he noted, which was not available last year.

“Second major overage is our workshop area. As you can see, overall, the city’s fleet of equipment resulted in the loss of just over $1.2 million.”

Fuel, repair, and maintenance costs caused most of that, Acker said, a reflection of the fact that most of the city’s public works fleet has been retained too long and is overdue for replacement.

Acker reminded council how dependent the city is on third party help, and that having an accumulated surplus in reserve of approximately 5 per cent of the operating budget, or $2.7 million, is the safe place to be. That goal was last met in 2017.

“That reserve’s primary purpose is to cover off years when we have a deficit, like this year. Unfortunately, we don’t have that in place.”

Acker said the city is in a fairly positive and stable position. However, various major capital projects are seriously challenging in terms of timing, debt, and obtaining sufficient outside funding.

The Crescent View Lift Station will cost around $60 million, the 4th Avenue Bridge will be well over $20 million, and a new outdoor pool could be in the $10 million range, he said, and they simply cannot be done all at once.

Reactions from council

“Thank you, Mr. Acker, to you and your staff who have done such great work,” Councillor Crystal Froese said. “It is a good reminder, though, that we are feeling the squeeze of the way things are right now.

“Mr. Acker is completely correct with some of the major projects that we have coming forward. We’re really going to have to be selective in how we choose those. But we also cannot do that without provincial and federal partners. There’s just no way that we can undertake those projects without their support.”

Councillor Heather Eby also thanked Acker for the report and commented on the importance of the accumulated surplus fund sitting at $178,000 instead of the $2.7 million it should be at.

“I know in the past, when there’s been money added into it, it feels sometimes around this table [that] people want to be like, ‘Oh, let’s spend that because we can do this, and this, and we’ve got this extra money.’ But Mr. Acker has always been very good about reminding us that the time could come that we need to dip into that, and if it’s not there, it’s problematic.

“Hopefully, we’ll add to the accumulated surplus again over the next couple of years. And if we do, that’s great, but let’s be mindful that that doesn’t mean it’s Christmas time and we can go shopping.”